Contents

It starts with a bullish gap up, making it possible for bulls to push the price even further upward. Traders observe the formation of a morning star pattern on the price chart. They then can confirm it with their other favorite technical tools .

The edge, if there is any, simply tends to be too weak, and you’ll need to introduce additional filters to improve the profitability of the signal. The Japanese Morning Star candlestick pattern is a three candle formation that has a bullish implication. Adding this additional layer of confluence to the Morning Star set up will help to increase the probability of success. The Morning Star pattern is considered a strong indication of a potential bullish price reversal.

The idea behind the https://forex-world.net/ Morning Star is that the bearish momentum is about to end, and the bulls will take charge soon. It is the opposite version of the Evening Star candle pattern that appears at the end of an uptrend and signals a bearish trend reversal. The first is a bullish candle, and the other is a bearish candlestick pattern. This pattern consists of two candlesticks, The first candle is bullish, and another is a small bearish candle that opens and closes inside the bullish candle. Three black crows pattern form when three bearish candles with no wicks are open above the previous candle’s closing and still close below the last candle’s low/ closing.

Then, you can enter the trade when the MACD histogram bars and the signal line rises above zero, and there’s a crossover of the two MACD moving averages. Trading Strategies Learn the most used Forex trading strategies to analyze the market to determine the best entry and exit points. Also, you should also learn other patterns to use them together with the morning star.

This candle at the top of an uptrend shows that bulls are getting weaker and unable to close the price higher. This pattern has a neckline, causing two candles to close at the same levels and form a horizontal neckline. The third candle confirms the change in trend by closing above them. We can open buying positions after the completion of this pattern.

The Evening Star candlestick is a three-candle pattern that signals a reversal in the market and is commonly used to trade in the stock market. Day one of the morning star pattern, as expected the market makes a new low and forms a long red/bearish candle. Ideally, there should be lower highs and lower lows in the market before a morning star candle stick appears. Here are some vital points to observe if you are looking for the formation of a morning star candlestick chart.

How to trade a Morning Star candlestick pattern?

Like any other chart pattern, the Doji Morning Star has pros and cons. So, let’s take a quick look at the pros and cons of the pattern. Funded trader program Become a funded trader and get up to $2.5M of our real capital to trade with.

- This is just an inverted hammer candle called a shooting star.

- The morning star candlestick appears circled in red on the daily scale.

- Since the morning star candlestick pattern is a visual pattern, the trader may not need to rely on multiple calculations to make sense of it.

- As such, you will need to use some other technical tool for exiting the trade.

- When price is flirting with moving average lines, whether above or below, pay close attention to that.

If the third candle is a bullish marubozu or candle with no upper or lower shadow, it speaks of the more bullishness. Its importance is even more if it is accompanied by increased volume. That is the point when the bears are unable to compete with the bulls. This causes the trend to reverse from a bearish downtrend to a bullish uptrend. After its occurrence, traders will usually anticipate the onset of an upward climb in the price of the security. Thus, it is clearly understandable why it is known as a reversal in the price pattern.

This is just a hammer candle called hanging man due to its location at the top of the uptrend because it looks like a hanging man, that’s why. You can have a trade go against you but patterns can help to alleviate that. Of course that doesn’t mean you’re not going to play a pattern and have it go wrong. They are also quite easy to identify but it is possible for a failed reversal to occur. In this case, the price of security may fall down even more. Gaps before and after doji are big which supports the strength of the pattern.

Because the accuracy of this candlestick pattern is not high in a sideways market. Finally, the third one is a bullish candlestick with the length at least equal to ½ of the first candle. However, Day 2 was a Doji, which is a candlestick signifying indecision. Bears were unable to continue the large decreases of the previous day; they were only able to close slightly lower than the open. Generally speaking, a bullish candle on Day 2 is viewed as a stronger sign of an impending reversal.

Learn to Trade

Live streams Tune into daily live streams with expert traders and transform your trading skills. It is easy to spot – As seen above, spotting the morning star pattern is relatively easy. There are several benefits of using the morning star pattern. In this case, you should look at a situation when the chart is forming lower highs and lower lows.

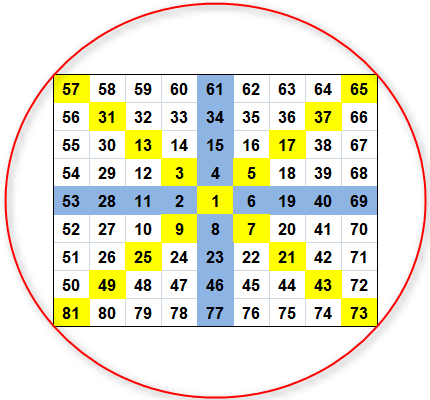

As always look for the big patterns as well as technical indicators for confirmation this pattern will break out. The best entry point is at the opening of the very next candle after the pattern is complete. For the conservative traders, it is better to enter after the closing of another candle so that they are sure of the price action. Morningstar candles have triple candlestick patterns that indicate a bullish reversal. The underlying structure is formed in an upward and downward trend, indicating that the downward trend will reverse.

However, if you use shorter lengths, you will have to adjust the threshold a bit. This is because the shorter length you use, the more quickly the ADX reading will surge and fall. As such, with the ADX-length set to 5, you could have readings that very well go above 70. Enter a market order to go along upon completion of the Morning Star pattern. The Stochastics indicator is a popular oscillator that provides oversold and overbought readings based on a default look back period of 14 days.

When an upward breakout occurs, price joins with the rising price trend already in existence and away the stock goes like a child’s helium balloon untethered. Identifying a morning star candlestick pattern is a relatively simple process. To begin with, you need to know how the candle looks like.

One of the ways to use the Morning Star pattern is through multiple timeframe analysis. This means looking for the Morning Star on longer timeframes and then zooming out to shorter timeframes to determine entry points. If you are a conservative trader, then you may choose to wait for the price levels to go higher. But the drawback of this technique is that the price can also go down. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Morning Stars: How To Trade the Morning Star Candlestick Pattern

They ideally would have wanted to take the market further downwards. But they failed to do so because of the strong presence of bulls. This candle also shows the infight among the bulls and bears. To identify this we should be looking for candles exhibiting lower highs and lower lows.

The Morning and the Evening Star patterns are powerful candlestick patterns that can help traders and investors identify potential price reversals in the financial markets. The Morning Star candlestick pattern refers to a bullish reversal pattern consisting of three candles in a trend. It signals the end of a bearish trend and the start of a new bullish trend. It consists of a large bearish candle, a small red candle, and a large bullish candle. The Morning Star Candlestick Pattern can be used on your trading platform charts to help filter potential trading signals as part of an overall trading strategy. When a morning star is backed up by volume and other technical indicators like a support level, then it can help to confirm the signal.

Professional access differs and subscription fees may apply. Futures and futures options trading involves substantial risk and is not suitable for all investors. Please read theRisk Disclosure Statementprior to trading futures products. The second candle of the pattern closes and opens below the lower Bollinger band. We’ll only enter a trade if the ratio is higher than 1.1.

Performance On All 75 Candlestick Pattern

The shape of the star is very similar to a Doji or a spinning top. But the formation is different, and hence, a careful analysis is required. This pattern is formed by three candles and is considered as an indication for a possible trend reversal in the market. Based on the above reasons, there was an outstanding buying opportunity, specifically because the CCI signaled days ahead of the reversal.

In the subsequent periods, the https://forexarticles.net/s are green and show higher highs. Unique to Barchart.com, data tables contain an option that allows you to see more data for the symbol without leaving the page. Click the “+” icon in the first column to view more data for the selected symbol.

What is the Morning Star Candlestick Pattern?

Since there are no guarantees in the https://bigbostrade.com/ market, traders should always adopt sound risk management while maintaining a positive risk to reward ratio. An easy way to learn everything about stocks, investments, and trading. This session either closes slightly up or below the opening price. The cable has an extremely small body forming either a Spinning Top or Doji.

In contrast, Green Mountain Coffee Roasters Inc. , Duke Realty Corporation , and American Tower Corporation are showing the Evening Star candlestick pattern. Since then we have continuously created the new and improved the old, so that your trading on the platform is seamless and lucrative. We don’t just give traders a chance to earn, but we also teach them how. They develop original trading strategies and teach traders how to use them intelligently in open webinars, and they consult one-on-one with traders.